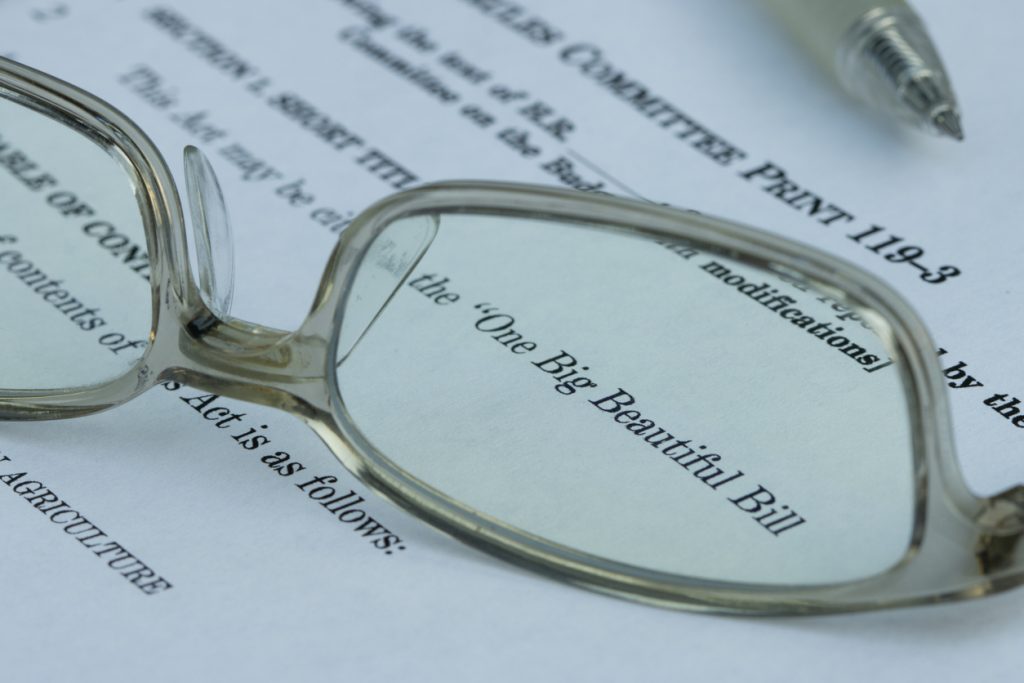

As we wrap up the year, we want to keep our clients, colleagues, and friends informed about significant tax law changes that may impact your 2025 planning. The recently passed One Big Beautiful Bill Act (OBBBA) brings several updates affecting both individuals and businesses:

Key Highlights:

For Individuals:

- SALT Deduction: Increased to $40,000 (with phase-downs for higher earners).

- Charitable Contributions: New AGI-based limits on deductions, plus an option for non-itemizers.

- Child Tax Credit: Raised to $2,200 per qualifying child.

- Estate Tax Exclusion: Increased to $15 million/person.

For Businesses:

- Depreciation: 100% bonus depreciation reinstated for qualifying property.

- Interest Expense Deductions: Calculation method improved for large taxpayers.

- Employee Meals: On-site meal deductions to be eliminated in 2026; travel meals remain 50% deductible.

- CA Pass-Through Entity Tax: Extended through 2030.

- Manufacturing-Specific Incentives: Immediate R&D expensing, expanded bonus depreciation for qualified production property, and more.

Now is the time to review these updates and adjust your tax strategies for 2025. If you have questions or want to discuss how these changes could affect you or your business, we’re here to help.

Wishing you a strong finish to the year and a successful 2026!

Contact us:

Hedman Partners LLP

(661) 287-6333